cars protection plus coverage compared fairly and clearlyYou want protection that matches how you drive, not just a brochure. This comparison-guide looks at cars protection plus coverage next to similar vehicle service contracts, with a priority-first lens so you can rank what matters most. What it generally aims to coverCore inclusions many drivers expect- Powertrain: engine, transmission, drivetrain components.

- Electrical & cooling: alternator, starter, water pump, select modules on higher tiers.

- Roadside help: towing, jump-starts; sometimes trip interruption.

- Rental reimbursement: daily limits while the vehicle is in a covered repair.

- Claims process: shop contacts administrator, approval prior to teardown when required.

Common exclusions to confirm- Maintenance items: brakes, tires, wiper blades, fluids.

- Wear-and-tear and pre-existing conditions: anything present before contract or due to neglect.

- Modifications: non-OEM tunes or parts that cause failures.

- Overheating or sludge where maintenance records are missing.

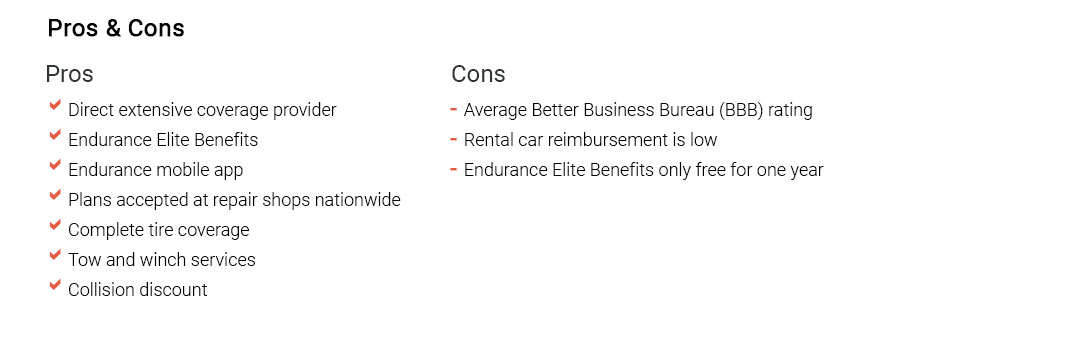

It's not only about "what's covered." Reframed: the value often hinges on how claims are approved, the deductible you choose, and whether your favorite shop can be paid directly. Comparison pillars (fairness first)1) Cost clarity- Premium vs deductible: lower monthly cost usually means higher per-claim expense.

- Fees: transfer and cancellation terms matter if you plan to sell the car.

- Tier differences: avoid paying for high-end electronics protection you don't need.

2) Claims experience- Pre-authorization speed: how fast a service writer gets an answer.

- Parts sourcing: new, remanufactured, or used - ask what's typical and who decides.

- Payment method: direct pay to shop is smoother than reimbursements.

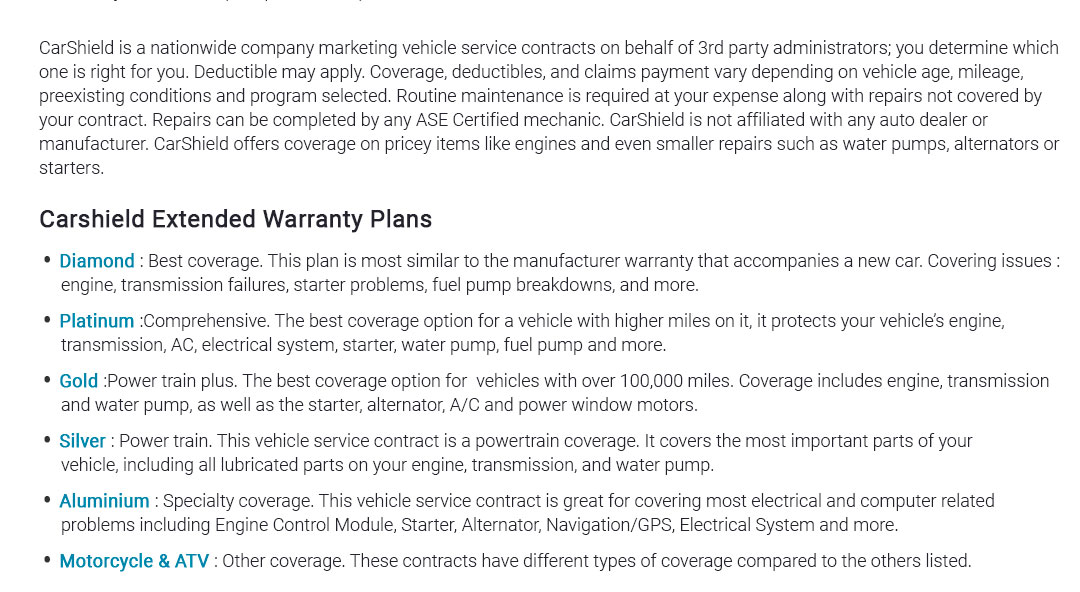

3) Repair flexibility- Shop network: any ASE-certified shop vs limited network.

- Diagnostics: who pays for teardown if a claim is denied.

- Regional coverage: moving states or traveling across borders.

4) Term and mileage- Length: select a term that outlasts common failure windows (e.g., 90k - 140k miles).

- Start point: begins at purchase date vs in-service date; verify odometer limits.

Choose by priority- Predictable budget: pick a higher tier with low deductible; ensure roadside and rental are included.

- Lowest total cost: mid-tier, higher deductible; accept some risk on non-essential systems.

- Convenience: prioritize fast pre-auth, broad shop choice, and direct payment.

- High-mileage keeper: focus on powertrain strength and cooling coverage; review exclusion wording closely.

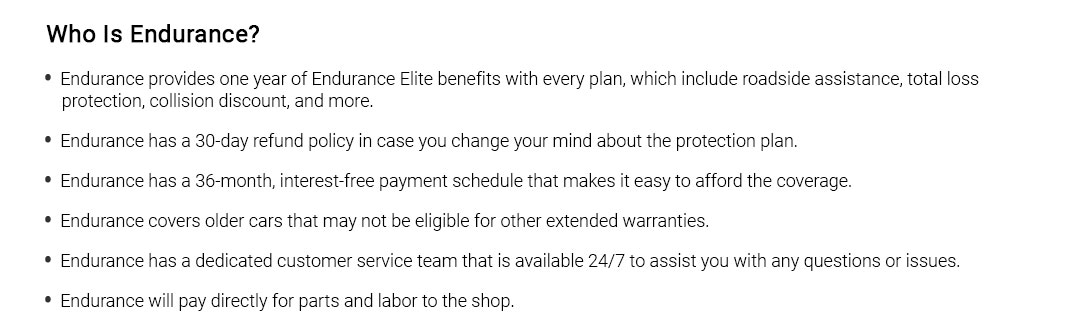

How it stacks up against other routes- cars protection plus coverage: multiple tiers, powertrain-centric value, roadside options; fairness depends on clear exclusions and records.

- Automaker extended plans: stronger OEM integration, sometimes pricier; dealer-centric repairs.

- Self-insure fund: maximum control; requires discipline and tolerance for timing risk.

A quick real-world momentRainy Wednesday, the alternator quits on the commute. With coverage in place, a tow is arranged, the claim is pre-authorized, and a short rental keeps a school pickup on time. The repair is paid directly, your out-of-pocket is the chosen deductible - nothing more dramatic than a calendar shuffle. Subtle but important checks- Records: oil changes and coolant intervals protect both the engine and your claim.

- Symptom vs cause: contracts pay for failed parts, not unrelated collateral items unless specified.

- Wear wording: "gradual deterioration" language can be pivotal; ask for examples.

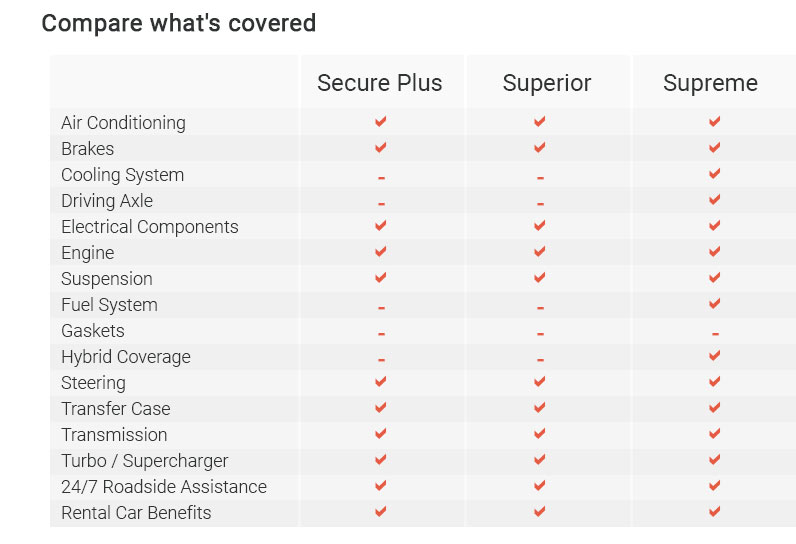

Coverage tiers, simply framed- Powertrain-only: least cost, covers the expensive heart of the vehicle.

- Stated-component: named systems like AC or fuel delivery; read the list.

- High-tier: broadest named parts; sometimes electronics and seals/gaskets included.

Read a sample contract in 8 minutes- Scan the definitions page; mark "covered failure."

- Circle deductibles and per-visit rules.

- Highlight exclusions; note wear-and-tear language.

- Check diagnostics/teardown responsibility.

- Confirm roadside and rental limits (daily caps).

- Find parts sourcing rules (new/reman/used).

- Note cancellation/transfer timelines and fees.

- Call and ask one hypothetical claim to test clarity.

Fair takeawaysIf you prize stability and quick help on bad days, cars protection plus coverage can be a fit, especially at mid-tier with a sensible deductible. If you drive few miles and keep a healthy repair fund, a plan might add less value. Same picture, different angle: the "best" choice is the one that protects your top priority - cost, convenience, or coverage depth - without paying for what you won't use.

|

|